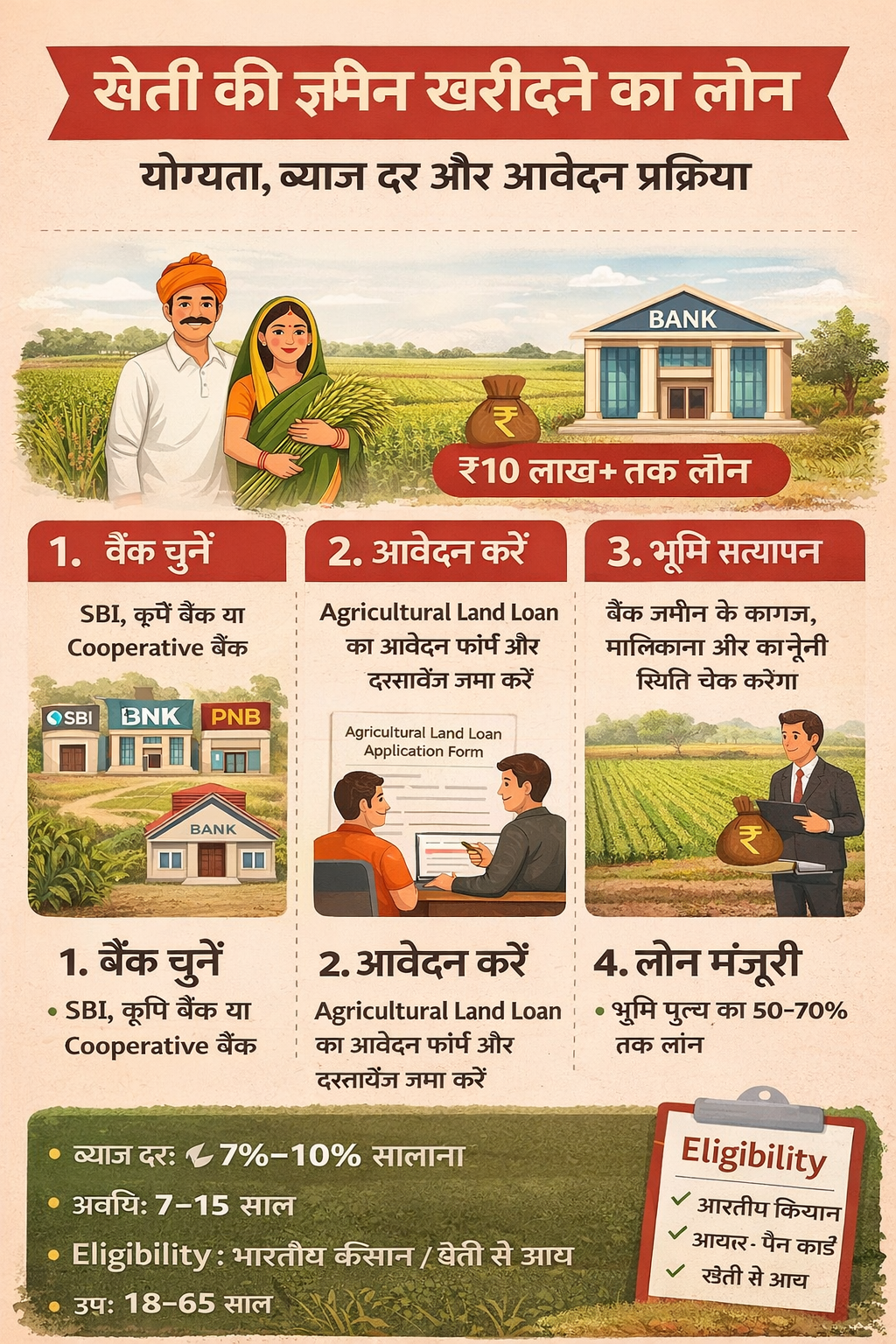

Loan for Agricultural Land Purchase: Eligibility, Interest Rate & Apply Process

Agricultural land kharidna farmers aur agriculturists ke liye ek badi investment hai. Iske liye banks aur financial institutions long-term loan provide karte hain. loan for agricultural land purchase Agar aap soch rahe hain loan for agricultural land purchase kaise mile, to is guide me aapko step-by-step process, eligibility, documents, interest rates aur tips sab milenge.

What is Agricultural Land Purchase Loan?

Agricultural Land Purchase Loan ek aisa financial product hai jisse Indian farmers aur agriculturists apni zameen kharidne ya farming expand karne ke liye paisa le sakte hain. Ye loan generally collateral-based hota hai, jahan kharidi ja rahi zameen ko bank security ke roop me rakhta hai.

Eligibility for Agricultural Land Purchase Loan -Eligibility, Interest Rate & Apply Process

- Indian citizen aur registered farmer

- Age: 18–65 saal

- Land purchase sirf agricultural purpose ke liye

- Farming income proof dikhana zaroori

- Bank ke hisaab se repayment capacity

Note: Non-agriculture log generally eligible nahi hote.

Required Documents for Eligibility, Interest Rate & Apply Process

Personal Documents

- Aadhaar Card

- PAN Card

- Passport size photo

- Eligibility, Interest Rate & Apply Process

- Eligibility, Interest Rate & Apply Process

Land Documents for loan for agricultural land purchase

- Sale agreement / Khata / Jamabandi / 7/12 extract

- Land use certificate (Agricultural)

- Ownership proof

Bank / Financial Documents

- Bank statement (last 6–12 months)

- Farming income proof

How to Apply for Agricultural Land Loan for Eligibility, Interest Rate & Apply Process

Step 1: Choose Bank

- Public sector banks: SBI, PNB, Bank of Baroda

- Regional Rural Banks (RRB)

- Cooperative banks

Step 2: Fill Application Form

- Bank me loan application form bharein

- Sab documents attach karein

Step 3: Land Verification

- Bank zameen ki legal status aur ownership verify karega

Step 4: Loan Sanction & Disbursement

- Loan amount generally 50–70% of land value

- Approval ke baad paisa direct seller ko transfer hota hai

Interest Rate, Loan Amount & Tenure

- Loan Amount: 50–70% of land value

- Interest Rate: 7%–10% per annum (state schemes/subsidy applicable)

- Tenure: 7–15 years, kuch cases me moratorium available

Tips for Loan Approval for Eligibility, Interest Rate & Apply Process

- Apply karein RRB / Cooperative bank se

- Land papers 100% clear honi chahiye

- Farming income ka proof ready rakhein

- Existing bank account jahan hai wahi prefer karein

- Land price realistic rakhein, overpricing avoid karein

Common Mistakes to Avoid for Eligibility, Interest Rate & Apply Process for Eligibility, Interest Rate & Apply Process

- Non-agricultural land par apply karna

- Court case ya disputed land purchase

- Weak income proof / repayment capacity

- Overpriced land

- Wrong bank selection

FAQs (Frequently Asked Questions) for Eligibility, Interest Rate & Apply Process for loan for agricultural land purchase

Eligibility, Interest Rate & Apply Process

Eligibility, Interest Rate & Apply Process

Eligibility, Interest Rate & Apply Process

Q1: Loan for agricultural land purchase kaise mile?

➡️ Bank me form fill karke aur required documents attach karke apply karein. Approval ke liye land verification zaruri hai.

Q2: Interest rate kitna hota hai?

➡️ 7%–10% per annum, state schemes aur subsidies ke hisaab se vary karta hai.

Q3: Collateral chahiye kya?

➡️ Haan, kharidi ja rahi land usually collateral hoti hai.

Q4: Repayment period kitna hai?

➡️ Generally 7–15 saal, kuch cases me moratorium bhi available.

Q5: Kya PAN aur Aadhaar zaruri hai?

➡️ Haan, dono documents personal identity ke liye required hote hain.

Q6: Kya non-farmers ye loan le sakte hain?

➡️ Mostly nahi, loan sirf registered farmers aur agriculturists ke liye hota hai.

✅ Conclusion

Agricultural Land Purchase Loan farmers aur agriculturists ke liye ek useful financial tool hai jo long-term farming expansion me help karta hai. Sahi bank selection, clear land documents, aur strong farming income proof ke saath loan lena kaafi simple hai. Ye loan financial stability aur future agricultural growth ke liye beneficial hai.

loan for agricultural land purchase

You May Like :- 5000 Loan on PAN Card – Puri Jaankari