What is State Farm Insurance ?

State Farm Insurance is a company that provides insurance coverage for various aspects of your life. It’s like a safety net that you pay for to protect yourself from unexpected events or losses.

Below are the demostrations of how to cancel state farm insurance

State Farm Insurance policy Exampes

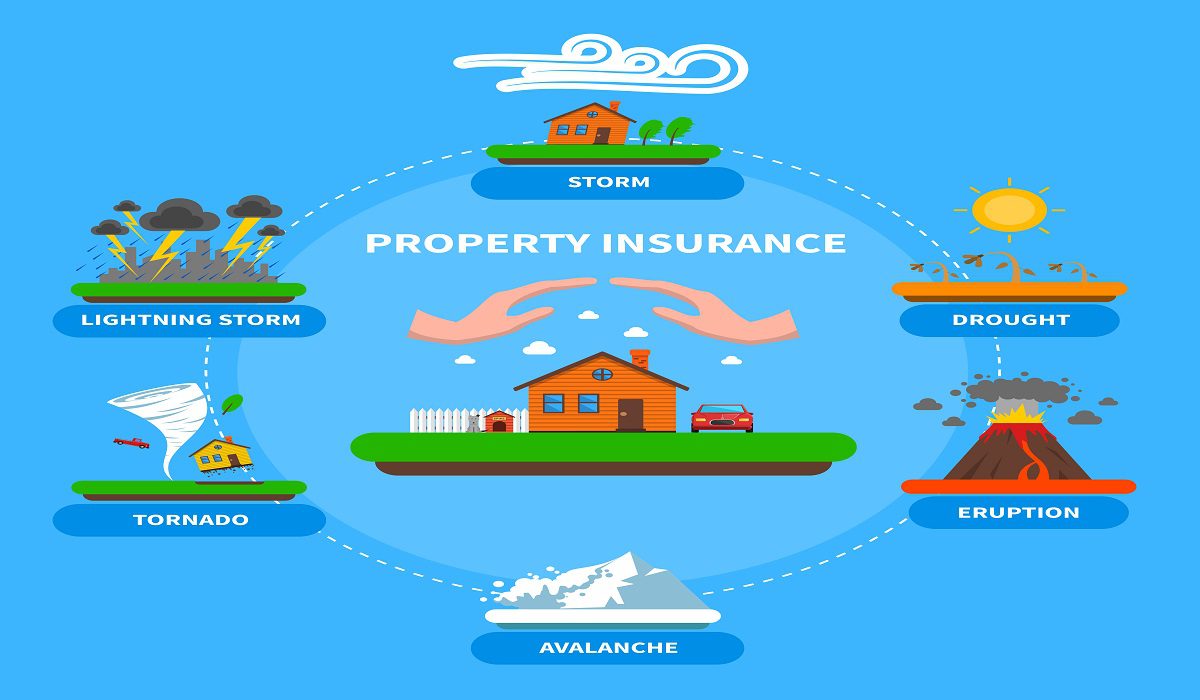

If your car gets damaged in an accident, they help pay for the repairs. If your home is damaged in a storm, they assist in covering the repair costs. They can even provide financial support if you’re in a car accident and someone gets hurt, helping with medical bills.

In exchange for this protection, you pay State Farm Insurance a regular amount called a premium. This way, if something unfortunate happens, you don’t have to bear the full financial burden on your own. State Farm is there to lend a helping hand and ease your worries when unexpected events occur.

Follow the steps of how to cancel state farm insurance

Step 1: Review Your Policy

Before you decide to cancel your State Farm Insurance policy, it’s essential to review your policy thoroughly. Take note of the coverage, premiums, and any additional benefits or riders you may have. Understanding your policy will help you make an informed decision regarding cancellation.

Step 2: Contact Your Local Agent

State Farm Insurance typically works through a network of local agents who handle policy-related matters. To begin the cancellation process, contact your local State Farm agent. You can find their contact information on your policy documents or the State Farm website. Schedule an appointment or speak with them over the phone to discuss your intention to cancel.

Step 3: Gather Necessary Information

When speaking with your agent, be prepared to provide the following information:

- Your policy number

- The reason for cancellation

- Could you please specify the effective date for the cancellation to be enacted?

Having this information ready will expedite the process and ensure there are no delays.

Step 4: Review Cancellation Policies

During your conversation with your agent, ask them about State Farm’s cancellation policies and any potential penalties or fees associated with cancelling your policy. Policies may vary depending on your location and the type of insurance you have.Gaining a grasp of these terms will empower you to make a well-informed choice.

Step 5: Request Cancellation in Writing

After your discussion with the agent, it’s a good practice to send a written request for cancellation. This provides a record of your request and ensures that there is no confusion regarding the cancellation date or reason.

Your written request should include:

- Your full name

- Policy number

- Contact information

- Date of the request

- An unequivocal declaration of your desire to terminate.

Step 6: Return Policy Documents

State Farm may require you to return your policy documents and any insurance cards. Ensure that you follow their instructions on how to do this properly. This step is essential to avoid any misunderstandings or disputes in the future.

Step 7: Monitor Your Account

After initiating the cancellation process, monitor your bank account or credit card statements to ensure that no further premium payments are deducted. If you notice any issues or additional charges, contact your local agent immediately.

Step 8: Confirm Cancellation

Once the cancellation process is complete, ask your agent for written confirmation of the cancellation. Keep this document for your records, as it may be needed for future reference or to provide proof of cancellation to other insurers.

FAQ About how to cancel state farm insurance

Q1: How do I start the process of canceling my State Farm Insurance policy?

A1: To begin the cancellation process, contact your local State Farm agent. You can find their contact information on your policy documents or on the State Farm website.

Q2: What information do I need when contacting my local State Farm agent? A2: Be prepared to provide your policy number, the reason for cancellation, and the desired date for the cancellation to take effect.

Q3: Are there any penalties or fees associated with canceling my State Farm Insurance policy?

A3: The cancellation policies and potential penalties or fees may vary depending on your location and the type of insurance you have. It’s best to discuss this with your local agent during the cancellation process.

Q4: Should I request the cancellation in writing?

A4: Yes, it’s a good practice to send a written request for cancellation after discussing it with your agent. This helps provide a clear record of your request and ensures there’s no confusion regarding the cancellation date or reason.

Q5: Do I need to return my policy documents or insurance cards when canceling my policy?

A5: State Farm may require you to return your policy documents and any insurance cards. Follow their instructions on how to do this properly to avoid any issues in the future.

Q6: How can I monitor my account to ensure that no further premium payments are deducted after initiating the cancellation process?

A6: Keep a close eye on your bank account or credit card statements to ensure that no additional premium payments are deducted. If you notice any issues or unexpected charges, contact your local agent immediately.

Q7: How can I obtain confirmation of my policy cancellation?

A7: After the cancellation process is complete, you can ask your agent for written confirmation of the cancellation. It’s a good idea to keep this document for your records, as it may be needed for future reference or to provide proof of cancellation to other insurers.

Q8: Can I cancel my State Farm Insurance policy at any time?

A8: Yes, in most cases, you can cancel your State Farm Insurance policy at any time. However, it’s essential to review the specific terms and conditions of your policy and discuss the cancellation process with your local agent to understand any potential restrictions or requirements.

Q9: What should I do if I have multiple policies with State Farm and only want to cancel one of them? A9: If you have multiple policies with State Farm and wish to cancel only one of them, discuss your specific situation with your local agent. They can provide guidance on how to proceed while keeping your other policies intact.

Q10: Is there a grace period after canceling my policy during which I can reinstate it without reapplying for coverage?

A10: State Farm may offer a grace period during which you can reinstate your policy without reapplying for coverage, but the availability and terms of this grace period can vary. It’s advisable to check with your local agent for details if you’re considering reinstating your policy after cancellation.

You May Like: What Big Insurance Companies Don’t Want You to Know About Rebating