Introduction to Property Tax

Property Tax is a mandatory tax imposed by local municipal authorities on real estate properties such as residential houses, commercial buildings, and land. Every property owner in India is legally required to pay it annually or semi-annually to the local municipal corporation or municipality.

The revenue collected through property tax is used for the development and maintenance of public infrastructure such as roads, water supply, sanitation, street lighting, drainage systems, and other civic amenities.

Property Tax is one of the most important taxes levied by local municipal authorities on real estate properties such as houses, flats, and commercial buildings. In India, every property owner is legally required to pay it to their respective municipal corporation or local body.

The revenue generated from Property Tax is used for public infrastructure development, including roads, water supply, street lighting, sanitation, and other civic services. Understanding Property Tax helps property owners avoid penalties and remain legally compliant.

What is Property Tax?

Property Tax is a levy charged by local government bodies on properties owned by individuals or organizations. It is calculated based on factors like the location of the property, size, usage (residential or commercial), age of the building, and construction type.

Property tax is applicable to:

- Residential properties

- Commercial properties

- Vacant land

- Industrial properties

Why is Property Tax Important?

Property tax plays a crucial role in urban development. It helps municipalities:

- Maintain basic civic facilities

- Improve infrastructure

- Fund public welfare projects

- Ensure cleanliness and sanitation

- Develop parks, roads, and public transport

For property owners, paying Property Tax on time helps avoid penalties and ensures compliance with legal ownership.

Types of Property Tax in India

1. Residential Property Tax

This tax is levied on houses, flats, apartments, and residential buildings used for living purposes.

2. Commercial Property Tax

Applicable to properties used for business purposes such as offices, shops, malls, hotels, and warehouses.

3. Vacant Land Tax

Charged on land that is not used for any construction or activity but falls within municipal limits.

4. Industrial Property Tax

Levied on factories, plants, and industrial units.

How is Property Tax Calculated?

Property tax calculation varies from city to city. Municipal authorities generally use one of the following methods:

1. Unit Area Value System

Tax is calculated based on the per-unit price of the built-up area multiplied by the property size.

2. Capital Value System

Tax is calculated based on the market value of the property.

3. Annual Rental Value System

Tax is based on the annual rental income the property can generate.

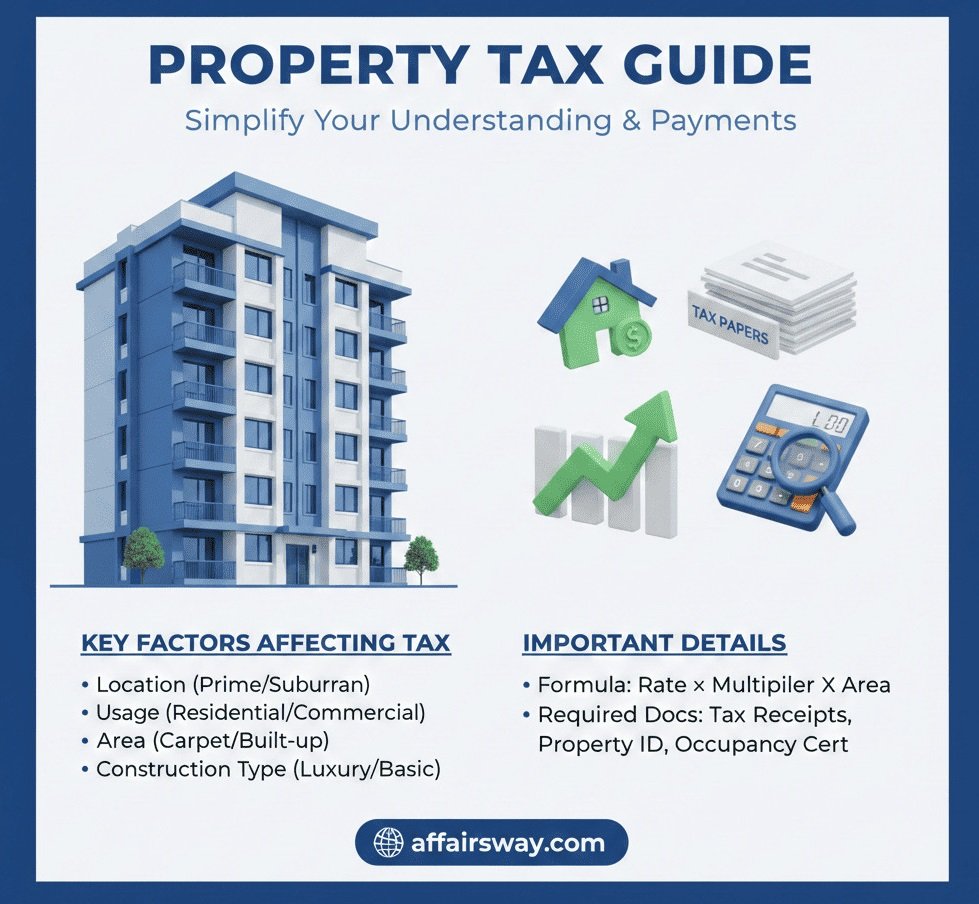

Common Factors Affecting Property Tax

- Location of property

- Property size and area

- Usage (residential/commercial)

- Age of the building

- Type of construction

- Floor level

How to Pay Property Tax Online?

Most municipal corporations in India offer online property tax payment facilities.

Steps to Pay Property Tax Online

- Visit the official municipal corporation website

- Select the Property Tax Payment option

- Enter property ID or assessment number

- Verify property details

- Choose payment mode (Debit Card, Credit Card, Net Banking, UPI)

- Make payment and download receipt

Online payment saves time and helps avoid late fees.

Offline Property Tax Payment Process

Property owners can also pay property tax offline by visiting:

- Municipal offices

- Authorized banks

- Citizen service centers

Payment can be made via cash, cheque, or demand draft.

Property Tax Exemptions and Rebates

Some categories of property owners may get exemptions or rebates, such as:

- Senior citizens

- Disabled individuals

- Ex-servicemen

- Government-owned properties

- Charitable institutions

- Agricultural land (in many states)

Early payment discounts are also offered by some municipalities.

Penalty for Late Payment of Property Tax

If property tax is not paid on time, penalties may apply:

- Late payment interest

- Additional fines

- Legal notices

- Restriction on property sale or transfer

Hence, timely payment is highly recommended.

Benefits of Paying Property Tax on Time

- Avoids penalties and legal issues

- Ensures proper maintenance of civic facilities

- Helps in smooth property resale or transfer

- Builds good compliance record

- Contributes to city development

Documents Required for Property Tax Payment

- Property ID or assessment number

- Sale deed or ownership proof

- Previous property tax receipt

- Identification proof

Types of Property Tax in India

1. Residential Property Tax

Levied on properties used for residential purposes such as houses, flats, and apartments.

2. Commercial Property Tax

Applicable to properties used for business or commercial activities like offices, shops, malls, hotels, and showrooms.

3. Vacant Land Tax

Charged on land that remains unused within municipal boundaries.

4. Industrial Property Tax

Imposed on factories, manufacturing units, and industrial buildings.

How is Property Tax Calculated?

Municipal authorities calculate property tax using different systems depending on the city or state.

1. Unit Area Value System

Tax is calculated based on the built-up area of the property multiplied by a fixed per-unit value.

2. Capital Value System

Tax is calculated based on the market value of the property.

3. Annual Rental Value System

Tax is calculated based on the estimated annual rent the property can generate.

Factors Affecting Property Tax Calculation

- Property location

- Built-up area

- Property usage (residential/commercial)

- Age of the building

- Construction type

- Floor level

How to Pay Property Tax Online (Step-by-Step)

Most Indian cities provide online property tax payment facilities.

- Visit the official municipal corporation website

- Click on Property Tax Payment

- Enter Property ID / Assessment Number

- Verify property details

- Select payment mode (UPI, Debit Card, Credit Card, Net Banking)

- Complete payment and download receipt

Online payment is fast, secure, and helps avoid late penalties.

Offline Property Tax Payment Process

Property tax can also be paid offline by visiting:

- Municipal corporation office

- Authorized banks

- Citizen service centers

Payment methods include cash, cheque, or demand draft.

Property Tax Exemptions & Rebates

Certain categories of property owners may receive exemptions or rebates:

- Senior citizens

- Persons with disabilities

- Ex-servicemen

- Government-owned properties

- Charitable and religious institutions

- Agricultural land (in most states)

Some municipalities also offer early payment discounts.

Failure to pay Property Tax on time can result in penalties, interest, and legal action by municipal authorities.

Failure to pay property tax on time can result in:

- Late payment interest

- Monetary penalties

- Legal notices

- Property attachment or restriction on sale

Timely payment is strongly advised.

Benefits of Paying Property Tax on Time

- Avoids penalties and legal action

- Ensures better civic amenities

- Smooth property resale and transfer

- Improves city infrastructure

- Maintains compliance record

Documents Required for Property Tax Payment

- Property ID / Assessment Number

- Ownership proof or sale deed

- Previous property tax receipt

- Identity proof

Frequently Asked Questions (FAQs)

Is Property Tax mandatory in India?

Yes, property tax is mandatory for all property owners within municipal limits.

How often is Property Tax paid?

Property tax is usually paid annually or semi-annually depending on local rules.

Can tenants pay Property Tax?

Legally, the owner is responsible, but tenants may pay if mentioned in the rental agreement.

Is agricultural land taxable?

In most Indian states, agricultural land is exempt from property tax.

Frequently Asked Questions (FAQs)

Q1. Is property tax mandatory in India?

Yes, property tax is mandatory for all property owners within municipal limits.

Q2. How often should property tax be paid?

Property tax is usually paid annually or semi-annually depending on local rules.

Q3. Can tenants pay property tax?

Generally, the property owner is responsible, but tenants may pay if agreed in the rental contract.

Q4. What happens if property tax is not paid?

Non-payment can result in penalties, interest, and legal action by municipal authorities.

Q5. Is agricultural land taxable?

In most states, agricultural land is exempt from property tax.

Property Tax is a vital source of revenue for municipal bodies and an essential responsibility for property owners. Understanding how it works, how it is calculated, and how to pay it on time can help avoid legal troubles and contribute to better urban infrastructure.

Property Tax is a vital source of revenue for municipal bodies and an essential responsibility for property owners. Understanding how property tax works, how it is calculated, and how to pay it on time can help avoid legal troubles and contribute to better urban infrastructure. With the availability of online payment options, paying property tax has become easier, faster, and more transparent.

Pay your Property Tax on time and play your part in the development of your city.

You May Like :- Why Staying Current on ITI Gold Loan Payments is Crucial for Your Financial Success